Click here to download P3 Financial Bulletin

Weekly Market Forecast: 2nd July – 8th July 2018

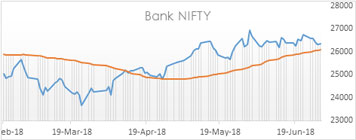

Indian broader market corrected its bullish move of last 5 weeks. The NIFTY ended in RED for the week at 10,714.30 (10,821.85 last week) down by 0.99%. The, BANK NIFTY also ended in RED and closed at 26,364.20 (26,766.85 last week) down by a strong 1.50%. Both Midcap and Small cap reacted in to the negative territory. BSE Midcap Index closed in RED at 15,450.90 (15,839.61 last week) and the BSE Small cap index also closed in RED at 16,032.15 (16,539.84 last week).

The bullish trend continues of the broader market but with a caution as the Indian rupee has slipped into an all-time low. Further, if crude oil moves up it will push inflation.

The US bourses made more cuts and closed in red again for a third consecutive week ending 29th June. Dow closed at 24,271.41 (24,580.89 last week) down 1.26%. Both S&P 500 and NASDAQ followed Dow and closed at 2,718.37 (2,754.88 last week) and 7,510.30 (7,692.82 last week) respectively.

Volatility was seen in both Gold and silver prices. MCX Gold Mini futures closed at 30,407 (30,520 last week) down by 0.37%. MCX Silver Mini futures, on the other hand, closed marginally higher at 39,945 (39,809 last week) stronger by 0.34%.

Crude oil made sharp gains again this week driven by output uncertainties. MCX Crude oil futures closed at 5,089 (4,675 last week) up by 8.85%.

This week, Indian Rupee depreciated against USD. USD/INR closed at 68.4700 compared to last week’s 67.8400.

Events in the week:

- Monday 02 Jul – China Caixin Manufacturing PMI (Jun); India Infrastructure Output (YoY); US ISM Manufacturing PMI (Jun)

- Tuesday 03 Jul – US Factory Orders (MoM, May)

- Wednesday 04 Jul – China Caixin Services PMI (Jun); India M3 Money Supply

- Thursday 05 Jul – US ADP Non-farm Employment Change (Jun); Services PMI (Jun); ISM non-manufacturing MPI (Jun)

- Friday 06 Jul – India Bank Loan / Deposit growth, Forex Reserves; US Non-farm payroll (Jun), Unemployment rate (Jun)

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Dr. Reddy: Buy @ 2122.10; Stoploss 2060.40; Target 2305.20

2. Eicher Motors: Sell @ 29219.10; Stoploss 29780.55; Target 28090.55

3. GAIL: Buy @ 321.15; Stoploss 314.70; Target 333.95

Last week’s Technical Call:

1. Bank of Baroda: Sell @ 123.45; Stoploss 124.25; Target 121.85…did not reach the price level

2. SBI: Buy @ 269.30; Stoploss 268.35; Target 271.20… entry into buy position on Monday missed by 20 paisa (target achieved)

Credit- Dr Amiya Sahu

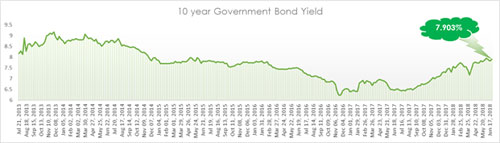

Bond market update

Bond yields rose by about 8 basis points (up by 1.07 %) during the week closing at 7.903% on selling pressures from banks and corporates.