Click here to download P3 Financial Bulletin

Weekly Market Forecast: 28th May – 03rd June 2018

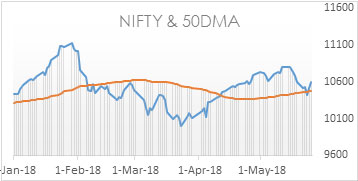

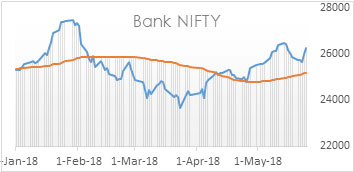

Although bulls dominated in the last two trading days, the market closed flat for the week. The NIFTY closed at 10605.15 (10596.4) up only 0.08%. However, BANK NIFTY outperformed NIFTY and closed at 26273.55 (25875.6) up a strong 1.54%. BSE Midcap snapped its three weeks of bearish trend and closed flat at 15904.41 (15895.68). However, BSE Smallcap continued its down trend and closed in red at 17151.43 (17326.78) down by 1.01%.

The markets monthly trend continues to be bullish. In the coming week, market movement will continue to be guided by Q4 results. Some of the key ones to look for are L&T, NTPC, OIL, Aurobindo Pharma, Bank of India, Divi’s Lab, etc.

The US bourses closed flat for the week. Dow closed at 24753.09 (24715.09) up 0.0.15% for the week. Both S&P 500 and NASDAQ too ended flat.

Both Gold and Silver inched up during the week. MCX Gold Mini futures closed at 31190 (31087), up 0.33%, MCX Silver Mini futures closed at 40324 (40194) up 0.32%.

Crude oil corrected sharply, especially on Friday. MCX Crude oil futures closed at 4604 (4855) down 5.17%.

This week, USD depreciated against INR. USD/INR closed at 67.8800 against last week’s 68.0150. USD was down by 0.35%.

SBI: SBI added to the negative profits reported by almost all banks. It reported the biggest ever quarterly loss of INR 7718 crore as provisions for bad loan doubled on a Q-o-Q basis. SBI’s Income was INR 68,436 crore for Q4 FY18 an increase of 18.57% compared to same quarter in the last year. However, its stock price rallied by a strong 3.86% after the announcement of the results.

Events in the week:

- Tuesday 29 May – US CB Consumer confidence

- Wednesday 30 May – US Nonfarm Employment change (May); GDP QoQ (Q1)

- Thursday 31 May – China Manufacturing PMI (May); India Fiscal deficit, GDP quarterly; US Pending Home sales MoM (May), Crude oil inventories

- Friday 01 Jun – China Caixin Manufacturing PMI (May); US Nonfarm Payroll, Unemployment Rate, Manufacturing PMI

The result calendar

- Monday: Bank of India, Bata, Divi’s Lab, L&T, NTPC, OIL, SAIL

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Biocon: Buy @ 651.85; StopLoss 648.05; Target 695.45

2. Bharat Forge: Sell @ 681.9; StopLoss 689.45, Target 666.8

Last week’s Technical Call:

1. HDFC Bank: Buy @ 1996.05; StopLoss 1990.45; Target 2007.25…stop loss triggered

2. Reliance Ind: Buy @ 936.75; StopLoss 926.45; Target 967.70… stop loss triggered

Credit- Dr Amiya Sahu

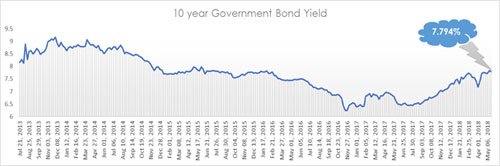

Bond market update

Bond yields eased by about 4 basis points (down by 0.52 %) during the week closing at 7.794% on renewed demand from corporates and banks.