Click here to download P3 Financial Bulletin

Weekly Market Forecast: 14th – 20th May 2018

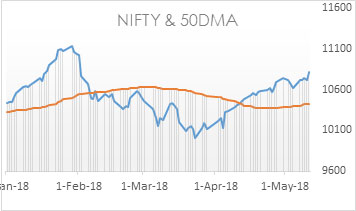

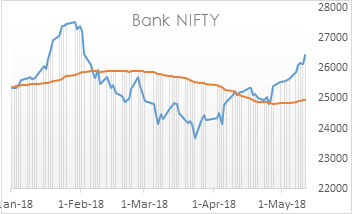

The market had a good bounce and ended in GREEN. The NIFTY closed at 10806.50 up 1.77% for the week. BANK NIFTY too continued its bullish move, it closed at 26413.5 for the week, up by 3.00%. However, both BSE Midcap and BSE Small cap indices continued to remain bearish. BSE Midcap closed at 16343.99 down 1.31%, and BSE Small cap also closed at 17818.09 down by 0.96%. The monthly trend for the broader Indian markets continues to be bullish. The next week market movement will continue to be guided by Q4 results, especially PSU banks and metals. The big ones to look at are Hindustan Unilever, Bank of Baroda, Bajaj Finance, Hindalco, JSW Steel, Tata Steel, TVS Motors, etc.

Global markets made a good upward move. The US bourses closed in GREEN snapping a three-week bearish movement. Dow Jones closed at 24830.11 up, a staggering 2.34% for the week. S&P 500 followed DOW and was up by 2.41%, NASDAQ too closed in green for the week, up 2.68%.

Both Gold and Silver closed in green as well for the week. MCX Gold mini futures closed at 31535, up 1.39% and MCX Silver mini futures closed at 40581 up by about 2%.

The Indian Rupee (INR) depreciated against US dollar. USD/INR closed at 67.3300 against last week’s 66.6450.

Eicher Motors: One of the biggest wealth creators in the Indian market backed by its blockbuster product Royal Enfield, Eicher continued its strong performance in Q4 FY18. Its total motorcycle sales were up 27% YoY. It reported a revenue growth of about 30% and EBITDA growth of 51%.

Events in the week:

- Monday 14 May – India Inflation data YoY (Apr18)

- Tuesday 15 May – China Industrial Production YoY (Apr18); US data on Retail Sales MoM (Apr 18)

- Wednesday 16 May – US Building Permits, Industrial Production and Crude oil inventories

- Thursday 17 May – US Philadelphia Fed Manufacturing Index (May)

- Friday 18 May – US Oil Rig Count

The result calendar

- Monday: Bank of Baroda, HUL

- Tuesday: PNB

- Wednesday: Bajaj Finance, Bajaj Finserv, Hindalco, JSW Steel, Tata Steel, TVS Motor

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. TATA CHEM: Buy @ 742.50; StopLoss 732.10; Target 773.40

2. IOC: Buy @ 168.25; StopLoss 167.50; Target1 169.75, Target2 171.25

Last week’s Technical Call:

1. HDFC: Buy @1888.45; StopLoss 1874.45; Target 1930.45 …Target achieved

2. USD/INR: Sell @ 66.6400; StopLoss 67.0100; Target 66.4550…Stop Loss triggered

Credit- Dr Amiya Sahu

Bond market update

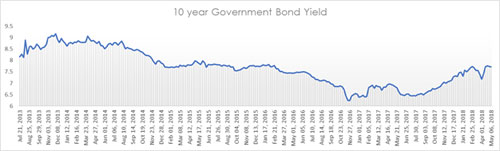

Bond market remained flat for the week closing at 7.726% as compared to last week’s 7.728%.

RBI has yet again failed to sell the debt it offered to bidders through auction fourth time in a row. It managed to sell only 2.7% of the 6.84% 2022 bond. Lack of demand is a serious worry as RBI is scheduled to borrow 6.05 trillion rupees this fiscal. Concerns pertaining to inflation and depreciation of currency have kept domestic and overseas buyers of bonds away from the auction, buyers have faced losses because of rising yields and are cautious as there is no clear-cut outlook of yields easing out. RBI on the other hand has been working to reduce the yields and increasing the demand for bonds, it already has announced buyback of bonds worth 100 billion rupees and eased the norms for overseas investments in short term bonds. RBI will have to further work on reducing the yields to attract bidders.